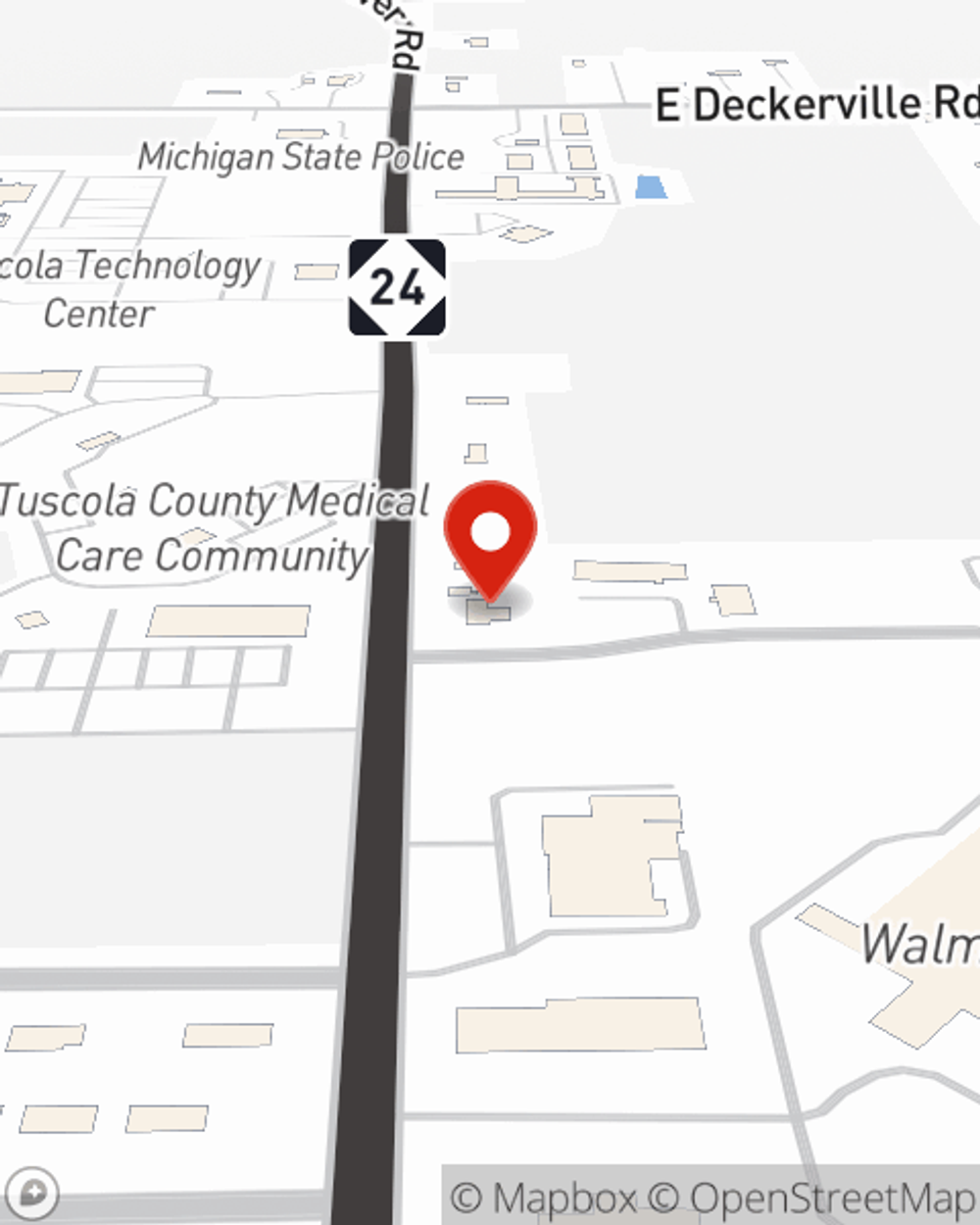

Business Insurance in and around Caro

Looking for small business insurance coverage?

This small business insurance is not risky

State Farm Understands Small Businesses.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

Looking for small business insurance coverage?

This small business insurance is not risky

Protect Your Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Chris Barrios is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Chris Barrios can help you file your claim. Keep your business protected and growing strong with State Farm!

So, take the responsible next step for your business and reach out to State Farm agent Chris Barrios to investigate your small business insurance options!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Chris Barrios

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.